Top 5 Improvements for Retirement – The Secure Act 2.0

What is the SECURE Act 2.0?

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, and brought a wide range of changes to the retirement planning landscape.

Nearly 3 years to the day after it was passed, the U.S. House of Representatives, on December 23, 2022, passed the Consolidated Appropriations Act of 2023, an omnibus spending bill that includes the much-anticipated and long-awaited retirement bill known as SECURE Act 2.0. The changes in the bill are great for savers, investors, employees, and employers. The following are the top 5 provisions that affect your retirement.

Roth SIMPLE IRA

Before the passing of the Act, SIMPLE IRAs could only accept pre-tax funds. Now, SIMPLE IRAs can offer a Roth option (after-tax). The IRS must still issue additional guidance to make this possible. Then employers will have to update plan documents, so it may take time for all companies to be on board.

Employers will be allowed to deposit matching and/or non-elective (bonus) contributions to employees’ designated Roth accounts. All employer funds treated as Roth will be immediately 100% vested. But note that the employer’s Roth contribution will be included in the employee’s gross income for the year.

SIMPLE IRAs have much higher contribution limits than Roth IRAs do. So now, you can put more than 2x the money into a Roth IRA that grows tax free and provides tax free distributions in retirement.

High-income earners were previously excluded from Roth IRA eligibility. Now, if these people are participating in a SIMPLE IRA, their contributions and matches can get the white glove Roth treatment.

Student Loan Payments Matched by Employers

Effective in 2024, employers MAY, but are not required to, amend their plans to allow employer matches for amounts paid by participants toward their student debt.

The average student loan debt balance is $37,787. When students graduate and head into the workforce with that kind of debt, paying it off sometimes trumps saving for retirement. Now, instead of missing out on years of retirement contributions while paying down student loan debt, employees can participate in the retirement plan at work and reap benefits from the time value of money. Vesting and matching schedules must be the same as if the loan payments had been salary deferrals. This is a great opportunity for employers to offer a benefit that will attract educated employees. Especially in industries that require post-graduate education.

529 Plan to Roth IRA Transfers Allowed

A 529 is a college savings plan. Until now, the money contributed to these plans must have been used for “qualified education expenses” or face a 10% penalty. Effective in 2024, 529-to-Roth transfers are allowed, with several limitations.

The new rule allows money that had been previously earmarked for education to be repurposed as retirement savings in the event those funds are not needed for education. Let’s say you started a 529 plan for your child when they were 2 years old. The child is an incredible athlete and receives a full ride scholarship to a university. Since the money will not be needed for education purposes, it can give the student a head start on retirement saving by transferring funds into a Roth IRA.

Catch Up Provisions & Contribution Limit Increases

People nearing retirement sometimes find that they have underestimated their savings need and are coming up short on their retirement goals. Catch-up provisions allow people aged 50 and older to contribute additional funds above the annual limit. Here are the changes:

- Instead of just being a flat $1,000 extra, the additional amount those 50+ can contribute to an IRA each year will be indexed to inflation. Starts in 2024.

- The possible match in a SIMPLE IRA will be raised from 2% of compensation (or 3% of compensation if a match) to 10% of compensation or $5,000 indexed to inflation, whichever is less. Starts in 2024.

- SIMPLE IRA contribution limits go up by 10% (Including catch-up contributions) Starts in 2024.

Required Minimum Distribution (RMD) Changes:

The Tax Reform Act of 1986 first established Required Minimum Distributions (RMDs) from qualified retirement accounts. An RMD is a yearly mandatory withdrawal from tax-deferred retirement accounts. The IRS let you defer taxes on your contributions and now they want their money. Or else. Before the act, there were incredibly hefty penalties for “RMD shortfalls”. The 50% shortfall penalty has been graciously reduced to 25%. If, however, the shortfall is rectified within the “Correction Window” the penalty is further reduced to 10%.

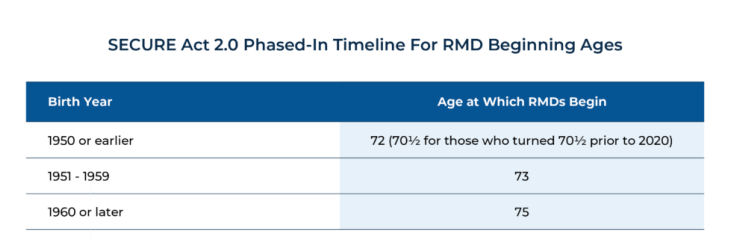

RMD ages have changed. The following table summarizes the ages at which RMDs are generally required to begin under SECURE Act 2.0

The penalty reduction and extended time period to rectify mistakes will save lots of money for people who treat their RMDs incorrectly. Ultimately, pushing back the age for RMDs is a neutral-to-positive change for most people. For individuals who already need to take distributions beyond their RMD level to support living expenses, the change is largely irrelevant. For some, however, the change will be viewed as welcome news, as it may allow them to push off retirement-account income for a few more years in an effort to stave off higher Medicare Part B/D premiums and, perhaps, to have a few more years of tax-efficient Roth conversions.

The SECURE Act 2.0 has changed the retirement landscape for the better. Lots of the changes discussed here will take time to implement and become reality. Business owners should look at these new laws as an opportunity to shift their business strategy and adopt new ways of investingin their employees’ retirement and their own. The savvy business owner will implement and advertise these new benefit programs to attract valuable employees. On the flip side of that coin, if you are a person looking for a new job, know that these new programs exist and seek out employers using them.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.